Regulatory hurdles deter M&A deal of MBK Partners

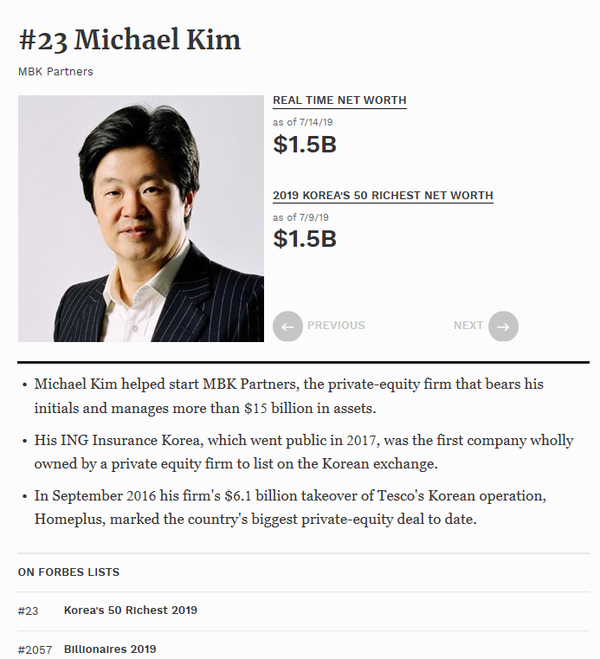

This year, there were two big acquisition deals in the country’s pay-TV industry. LG Uplus took over CJ HelloVision, and SK Telecom gobbled up T Broad. The two contracts now wait for reviews of the Fair Trade Commission.MBK Partners and creditors strive to ride the M&A wave to divest their long-time headache of D’Live, which the private equity fund purchased in 2008 for 2.2 trillion won ($1.8 billion).There happen to be a potential deep-pocketed buyer of KT, the country’s largest telecom carrier. But regulatory hurdles are feared to deter the two sides.In a recent session, the National Assembly failed to conclude whether or not to introduce regulation of preventing any pay TV operator from having a market share of higher than 33 percent.A similar three-year sunset law expired last year, but some assemblymen try to reinstate it.With around 10 million customers, KT already accounts for some 31 percent of the market. Hence, the addition of 2 million D’Live customers would increase KT’s share to 37 percent. Despite repeated requests, the country’s unicameral parliament has not concluded on the issue. KT officials say that it will not seek any M&A deal ahead of the Assembly’s decision.This is a piece of bad news for MBK Partners and creditors, which have struggled to exit D’Live because KT seems to be the only candidate to take over the country’s No. 3 cable TV operator.On a more negative note, KT might give up D’Live even if it gets the parliamentary approval. As KT Chairman Hwang Chang-gyu’s term finishes next March, some observers expect that Hwang would not make controversial investments just ahead of his departure.And the two sides are unlikely to agree on the price either _ the seller is expected to want to get at least 1 trillion won ($850 million), but the buyer is ready to pay at least 800 million won ($680 million). Some even claim that the proper price tag is 500 billion won ($429 million).From the perspective of MBK Partners and creditors, they don’t have much time because the profitability of D’Live deteriorated over the past five years.Things are likely to get worse in case its bigger competitors of CJ HelloVision and T Broad come up with marketing campaigns along with their new owners.In this climate, D’Live is dubbed as the second investment failure of MBK Partners and its founder Michael Byung-ju Kim.Since its foundation in 2005, the buyout fund has raked in handsome profits in many of its investments. Thanks to the success of the fund that bears his initials, Chairman Kim has become one of the richest businessmen in Korea.In its recent announcement, the Forbes said that Chairman Kim has a fortune of $1.5 billion to become the 23rd richest Korean.However, not all of his investments have been successful. For example, Young Hwa Engineering, a producer of steel and metal structures, entered court receivership in 2016. NEPA, an outdoor apparel manufacturer, also languishes.Comments from MBK representatives were not available. Related storiesNEPA: Another headache of MBK?

MBK’s long struggle to exit D’Live

이 기사를 공유합니다

Tim Kim

(voc200@gmail.com)